2020年是一个非同寻常的年份

今年这份股东信里

伯克希尔拥有美国最大的铁路公司BNSF

有时候判断一个人的态度

这封股东信

巴菲特用很长的篇幅

以下为我自己摘选的原文

- No one misled me in any way – I was simply too optimistic about PCC's normalized profit potential. Last year, my miscalculation was laid bare by adverse developments throughout the aerospace industry, PCC's most important source of customers.

没有人在任何方面误导我

- I believe I was right in concluding that PCC would, over time, earn good returns on the net tangible assets deployed in its operations. I was wrong, however, in judging the average amount of future earnings and, consequently, wrong in my calculation of the proper price to pay for the business.

PCC is far from my first error of that sort. But it's a big one.

我相信我的结论是正确的

PCC远不是我第一次犯这样的错误

- "Investing illusions can continue for a surprisingly long time. Wall Street loves the fees that deal-making generates, and the press loves the stories that colorful promoters provide. At a point, also, the soaring price of a promoted stock can itself become the 'proof' that an illusion is reality."

投资幻想可以持续令人惊讶的长时间

- Eventually, of course, the party ends, and many business

当然

- Risky loans, however, are not the answer to inadequate interest rates.

然而

- The math of repurchases grinds away slowly, but can be powerful over time. The process offers a simple way for investors to own an ever-expanding portion of exceptional businesses.

回购的影响积累得很慢

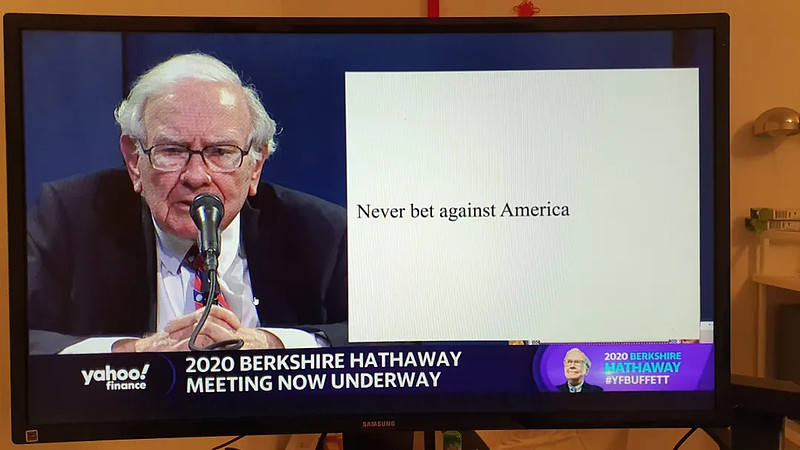

- Our unwavering conclusion: Never bet against America.

我们从不动摇的观点

- Neither of us had any institutional investors, and very few of our partners were financially sophisticated. The people who joined our ventures simply trusted us to treat their money as we treated our own. These individuals – either intuitively or by relying on the advice of friends – correctly concluded that Charlie and I had an extreme aversion to permanent loss of capital and that we would not have accepted their money unless we expected to do reasonably well with it.

我们没有任何机构投资者

- Therefore, the 1983 annual report - up front - laid out Berkshire's

因此

- All of that said, Charlie and I would be less than human if we did not feel a special kinship with our fifth bucket: the million-plus individual investors who simply trust us to represent their interests, whatever the future may bring. They have joined us with no intent to leave, adopting a mindset similar to that held by our original partners. Indeed, many investors from our partnership years, and/or their descendants, remain substantial owners of Berkshire.

说到这里

- Could it be that Berkshire ownership fosters longevity?

难道是伯克希尔的所有权培养了长寿

- When seats open up at Berkshire - and we hope they are few - we want them to be occupied by newcomers who understand and desire what we offer. After decades of management, Charlie and I remain unable to promise results. We can and do, however, pledge to treat you as partners.

And so, too, will our successors.

当伯克希尔出现空位时

我们的继任者也将如此

公安备案号 51010802001128号

公安备案号 51010802001128号